With over 25 years of experience as a licensed architect, entrepreneur, and commercial real estate investor in Charlotte, Ryan Carver has been closely monitoring the dynamic trends within both the U.S. and Queen City markets. Ryan recalls these changes as market conditions, such as increased demand or limited supply, can lead to rising rates, potentially affecting mortgage rates and costs for buyers and developers. These fluctuations can significantly impact market rate deals and affordable housing projects alike. Delving into the issues and developments, Ryan shares his insight on navigating the Multifamily industry:

The multifamily market is constantly evolving, with a multitude of factors creating long-lasting changes we see every day. These factors include market conditions, debt-to-equity ratio, bank regulation, capitalization rates, rent growth, contractor backlog, increased hard & soft costs, macro-economic shifts, and supply chain issues. While this list of variables may seem daunting, it’s important to understand how to navigate transitions to make informed decisions and, at the very least, get the inside scoop on how stakeholders in the real estate industry are streamlining despite uncertainty. Reflecting on rent growth stalling and the changing price of real estate in growing markets this year, one can learn to navigate the current state of the market effectively and successfully.

For market rate deals, developers are having to become ever more creative to structure deals creatively. On the other hand, “affordable housing” is also struggling to keep up with demand. In response, the economy has allocated $33 million to approved cost-effective deals, illustrating a commitment to affordable housing. One misnomer about affordable housing is that it is as expensive to build as market rate, if not more expensive due to the additional scrutiny, oversight and processes. This allocation could be a catalyst for certain sectors of development. It will be up to developers to make the choice as to whether or not they will capitalize on the opportunity within this sector.

Despite recent market conditions, there has been significant rent growth of 40% in certain segments of the market, indicating high demand for rental properties. This is especially true in areas where the cost of living is high, such as major cities and metropolitan areas. Rent growth indicates that the rental market is responsive to the ebb and flow of tenants and their interest in rental arrangements. In speaking with our developer clients, rent increases have tapered off over the last 6 months, which could signify broader market challenges or decreased demand. In Charlotte, the demand has not slowed but the ability to find sites devoid of costly issues, elevated construction costs, additional lending scrutiny and similar concerns has slowed the ability for developers to meet the demand. Fewer deals indicate that developers are seeking quality deals over quantity as the metrics for a successful deal have changed. Therefore, as one can imagine, 2024 is predicted to be a quiet year, and with any luck 2025 will be the return to a more “normal” market demand or at least perhaps a new normal.

As the supply of available deals decreases, competition for the remaining properties will increase, potentially driving up prices in the process. The scarcity of deals can make it harder for buyers or investors to find viable properties. When analyzing this decline, there is a sign of a potential market shift, allowing for uncertainties to become apparent when investing in the short term. Meanwhile, capitalization rates have been increasing, particularly in the value-add segment. Cap rates basically measure the amount of upside to a development project. As these increase the margins for a successful investment or project decrease. In response, developers are seeking private equity partnerships, landowner equity partnerships, federal funding programs such as HUD (where time is not a critical element) as well as Opportunity Zones. If you haven’t investigated Opportunity Zones, now may be a good time to start. These projects offer incentives for ownership groups who are willing to hold onto deals for longer periods of time (approximately 10 years).

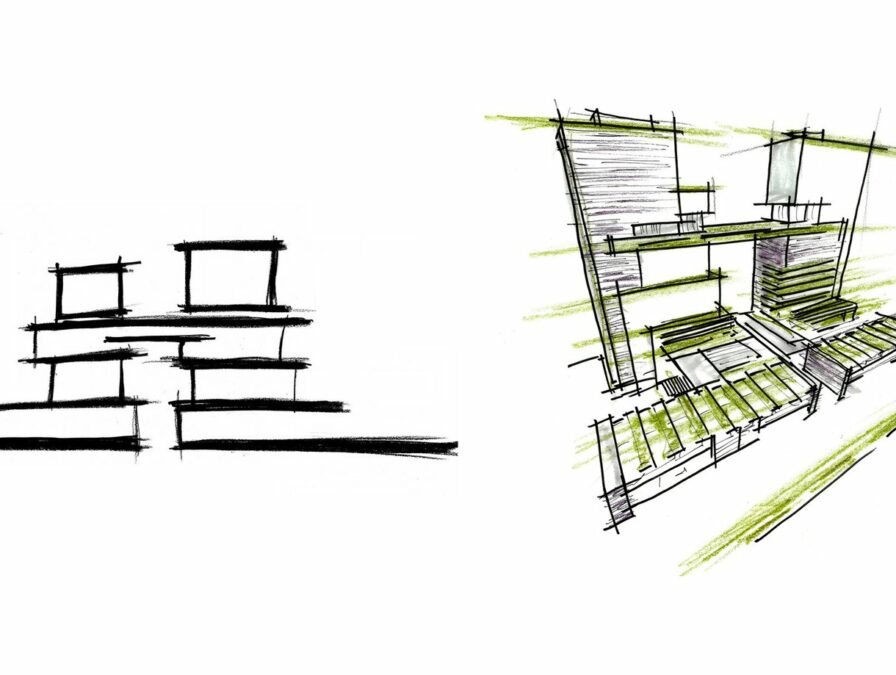

While there are fewer deals happening in the private development now, I have also heard of deals not moving forward. This can be attributed to market uncertainty, changing economic conditions and/or increased lending requirements. Thankfully, in the last year or so SGA|NW and our clients have continued to see deals through to completion by increased due diligence on potential sites, introducing potential partnering opportunities between various clients, creating quality work more efficiently, building knowledgeable teams, the utilization of client-specific prototypes, in-house entitlement work and anything else that shortens the runway to closing while removing challenges & obstacles. to ensure the success of any project.

The rise in hard costs has become a major factor in the multifamily economic landscape and is a major consideration for developers and investors when embarking on a new venture. This can be attributed to inflation or higher construction expenses. Inflation has a direct tie to the viability of development projects. The SGA|NW team has been working to combat these increases with cost-effective strategies and technologies, tailored specifically to each project and client.

As a firm, we are leaders in the multifamily and private development industries. We have been combating issues of market softening by advising strategy & approach to new markets, researching trends and providing products to meet the changing landscape in the market. This has allowed us the opportunity to provide comprehensive and innovative solutions to our clients amidst trying times. As the multifamily market continues to soften, we have identified strategies to help our clients navigate the current environment. As always, we will continue to take a proactive approach to solving problems in order to create quality projects that help our clients succeed. We will also continue to stay on top of emerging trends and technologies to advance the multifamily industry so stay tuned for the next iteration of this ongoing discourse.

About Ryan Carver: Ryan Carver, Managing Director of SGA|NW, a GF design company, is a licensed architect with more than 25 years of experience in the industry. Many of these years have been spent consulting in private development, creating client relationships, managing design teams, offering advice on marketing trends & business, as well as mentoring team members. With an entrepreneurial spirit and design-build origins, Ryan Carver was the winner of the Traveling Fellowship Award and serves on the ULI Affordable Housing Committee. He received his Bachelor of Architecture from the University of North Carolina at Charlotte and is AIA, CDT, and NCARB certified.

>For more information regarding deals, construction costs, and all things related to the fluctuating multifamily market, reach out to Ryan Carver.